- BTC Wealth

- Posts

- BTC Wealth Report – Issue 14

BTC Wealth Report – Issue 14

Bitcoin Smashes ATH—Trump Demands Historic Rate Cuts.

👋 Welcome to BTC Wealth — Issue 14

Bitcoin finally ripped through its all-time high, pushing decisively above $120,000.

We've been tracking BTC Treasury flows, relentless ETF buying, and a money printer that just won't stop—but why now? What triggered the breakout?

It’s Trump.

He’s cranking up the heat - publicly demanding a 300 basis point (!!!) rate cut.

It’s an outrageous ask by any historical standard, but that doesn’t matter now.

Trump’s desperate for a cut and it’s igniting the market.

Here's what we’re tracking this week,

🚨 Bitcoin Hits ATH: What's fueling the fire?

📉 Trump Wants a 300bps Cut:🤣🤣🤣

🧨 Debt Bomb: U.S. interest payments are $1.2T—and going higher

📅 Jerome Powell’s Early Exit? The pressure is on

📈 ETF Watch: Bitcoin inflows keep surging

Let’s dive in.

🚨 Bitcoin Blasts Through All-Time Highs

After weeks (months!) of teasing us around the previous ATH, Bitcoin finally smashed through, hitting $122,000 and setting fresh highs. We're officially in uncharted territory.

Back in April, Trump tweeted: "THIS IS A GREAT TIME BUY!!!" — I’ve included that exact tweet on the chart for reference.

Not because he perfectly called the bottom (impressive as it appears at first glance)—but because Trump isn’t a passive observer here:

He’s in the driver’s seat.

And he’s flooring it.

📉 Trump's Rate Cut Push: 300bps or Bust

Trump is banging the table, publicly demanding a colossal 300+ basis point interest rate cut from the Fed.

Let me put that into perspective:

The Fed has never— not even once—cut rates by 75bps or more outside of a recession.

We're currently nowhere near recession territory—meaning Trump is effectively calling for the biggest rate cut in U.S. history into a relatively strong economy.

🛢️ Is Trump Just Pumping His Own Bags?

It's no secret Trump’s wealth is heavily tied to crypto—and yes, there's a glaring conflict of interest here. But conveniently, Trump actually has a credible case that aggressive rate cuts are in America's national interest, too.

Here's why:

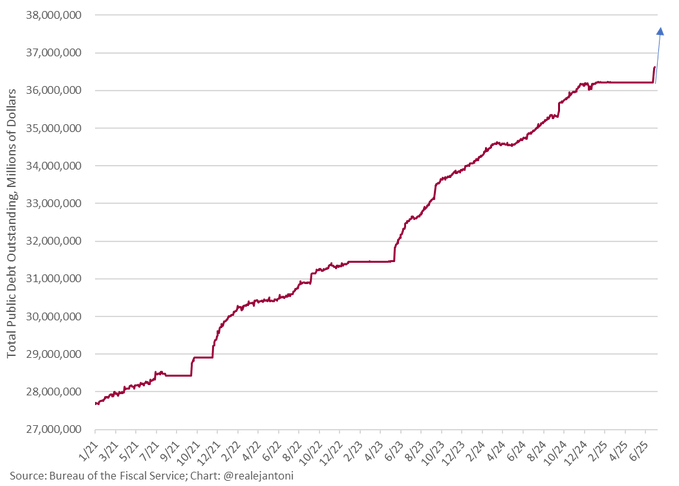

Last week, Trump's so-called "Big Beautiful Bill" was signed into law, raising the U.S. debt ceiling from $36.1 trillion to $41.1 trillion. Washington once again kicked the can down the road—but the debt problem hasn't disappeared. It's only accelerating.

Interest expenses are out of control:

In 2024 alone, the U.S. paid a staggering $1.2 trillion just on interest payments.

On the current trajectory, annual interest payments will soon top $2 trillion, exceeding the combined budgets for Defense, Medicaid, and Veterans Affairs.

Make no mistake—this debt trajectory is completely unsustainable.

Trump’s proposed massive rate cuts offer a lifeline: allowing the U.S. government to refinance its ballooning debt at drastically cheaper rates, potentially saving hundreds of billions annually.

But there’s one huge problem…

🛑 Powell’s Counterpoint: It’s Never That Simple

The Fed can lower short-term overnight rates, sure, but long-term rates are set by bond markets—not the Fed.

If investors see aggressive Fed rate cuts into a non-recession economy, they'll smell inflation immediately. Who wants to lock in 2–3% returns on government bonds when the inflation dragon wakes back up?

Ironically, massive short-term cuts could spike long-term rates as bondholders demand higher yields to compensate for the inflation risk.

Ultimately, there would be just one reliable buyer left for those bonds: the Federal Reserve itself—effectively money-printing to finance U.S. debt.

This may be inevitable, but Powell doesn’t want his legacy tied to this mess.

📅 Jerome Powell’s Early Exit?

Officially, Jerome Powell’s term as Fed Chair ends on May 15, 2026.

But Trump isn’t waiting—he’s already publicly floated the idea of naming Powell’s replacement by September or October 2025.

A clear power move intended to make Powell a lame-duck Fed Chair, undermining his influence during a crucial period.

That’s not all

On July 11, 2025, the Chairman of Fannie Mae and Freddie Mac, William J. Pulte, issued a supporting reports that Jerome Powell is considering resigning early:

"I'm encouraged by reports that Jerome Powell is considering resigning. I think this will be the right direction for America, and the economy will boom."

— William J. Pulte, Chairman, Fannie Mae and Freddie Mac

It’s not even clear that Powell is considering resigning - but it’s all pressure.

Trump wants easy money, he wants rate cuts—and he wants them now. Investors have figured out exactly what this means. Powell is under siege, the Fed is moving towards dovish territory, and the market is already positioning itself.

It’s no coincidence Bitcoin just ripped through fresh all-time highs.

📈 ETF Watch: Inflows Pour In Driving BTC ATHs

No surprises here, ETF flows were coming hard this week ($2.5B worth if you don’t mind)

BlackRock (IBIT): +15,199 BTC

Fidelity (FBTC): +3,556 BTC

ARK (ARKB): +2,9909 BTC

Total weekly net inflows: +23,611 BTC

YTDs, ETFs have absorbed 156,000 BTC

To put this in perspective, ETFs have bought double the amount of BTC Mined this year.

Final thoughts

Trump’s jawboning the market higher, and investors are happy to go with it.

If Trump gets his way, the Fed will pour gasoline on markets.

If he doesn’t, the debt problem worsens rapidly.

Either scenario creates powerful tailwinds for Bitcoin.

Bitcoin’s hitting ATHs not just because of immediate buying pressure—but because long-term, systemic fiat weakness is becoming obvious.

That’s your BTC Wealth Report this week.

Found this valuable? Share this with your friends.

Thank you!

— Thomas Fahrer