- BTC Wealth

- Posts

- BTC Wealth Report – Issue 13

BTC Wealth Report – Issue 13

How Bitcoin Eats the $300T Debt Market

👋 Welcome to BTC Wealth — Issue 13

This week, we’re digging into one of the most underappreciated — and potentially transformational — developments in Bitcoin:

The rise of Bitcoin-backed credit markets.

Not the retail “borrow against your BTC” from last cycle.

We’re talking about something much bigger:

A yield curve, built on Bitcoin.

It’s early, but the architecture is forming.

And as Bitcoin continues to mature as an asset, this will become foundational.

That’s our focus today.

(And yes — we’ve got ETF flows too. Let’s get into it.)

💰 $300 Trillion Is Looking for Yield

Before we get to Bitcoin-backed debt, let’s zoom out and understand the scale of the market we’re talking about.

The global debt market is over $300 trillion.

That’s one-third of all global wealth sitting in instruments designed to generate yield.

“With stocks, you have to worry about the market. With debt, I just have to understand the contract. If my analysis is right, I’ll make money.”

People crave security.

They want predictability. Promises.

A known future.

Debt offers a simple contract:

“I’ll give you my wealth — just give me a little more back each year.”

Media tends to obsess over stocks.

But in reality, debt markets are far larger — and they exist because most humans are, by nature, risk-averse.

Not everyone fits that mold, of course.

Some prefer volatility and upside.

They want exposure to appreciation — not just a coupon payment.

This divergence in investment preferences is exactly what creates the opportunity for financial engineering — and why Bitcoin-backed debt is so intriguing.

🧠 Different Strokes For Different Folks

Not all investors think the same way about Bitcoin — or the future.

Some think like Michael Saylor:

“1 BTC will be worth $21 million by 2046.”

Most aren’t that bullish.

Or maybe they’re just not that patient.

Some investors want:

A guaranteed yield — low risk, steady return

A higher yield — in exchange for taking on some risk

Pure upside — no yield, just exposure to Bitcoin’s price

The idea is to use Bitcoin as the underlying engine.

And to carve up the return profile to give everybody something they want.

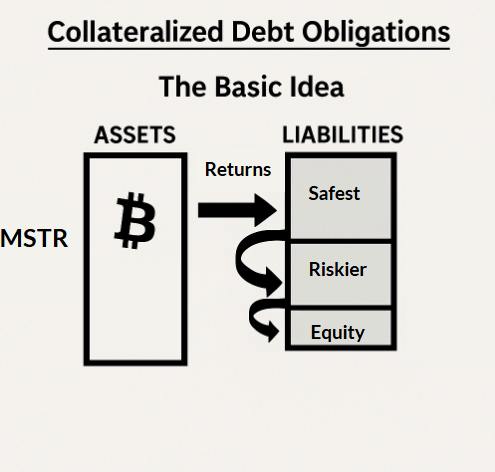

This is possible through Collateralized Debt Obligations (CDO’s).

🏗️ The Bitcoin Yield Curve

Here’s the basic idea:

Strategy holds a massive Bitcoin reserve.

They use that BTC as collateral and issue different “tranches” of debt:

✅ Senior Tranche – Safest

⚠️ Mezzanine Tranche – More risk, higher yield, convertible to equity

🔥High Yield Debt - Highest yield

🚀 Equity Tranche – Highest risk, but uncapped upside

🛡️ Why This Could Never Exist Before

Bitcoin is volatile. That’s always been the problem.

You can’t create safe debt instruments without collateral certainty.

Bitcoin Backed Debt doesn’t work… unless the collateral is:

Massive

Over-collateralized

Permanent

And now Strategy (and the coming crop of BTC Treasury companies) are able to make it possible.

They’ve stacked 597,325 BTC on their balance sheet.

That’s ~$64B in collateral — and growing.

Even if Bitcoin fell 75%, senior debt holders are still well-protected.

That’s the key unlock. That’s what makes these CDOs viable.

🧱 The Products: Strategy’s Bitcoin Tranches

Strategy Debt Offerings and their Yield

Today, Strategy offers three live products:

STRF (Strife): Senior tranche — highest security, lowest yield

STRK (Strike): Mid-risk tranche — convertible into equity, with upside if Bitcoin moons

STRD (Stride): Junior tranche — highest risk, highest potential yield

Each has raised approximately $1 billion — and yields are already tightening.

Why?

Because once you understand the mechanics — high yields on 10x over-collateralized loans — you realize these products are wildly attractive compared to traditional corporate debt.

🌎 This Unlocks Bitcoin for Debt Markets

Let’s return to that number: $300 trillion in global debt.

That’s one-third of all global wealth — parked in yield-seeking instruments.

Now imagine what happens when just a sliver of that capital realizes:

“Hey, this Bitcoin-backed debt offers better yield and lower risk than even the highest quality corporate bonds”

…it will unlock massive inflows

Pension funds, retirees, institutions —

They don’t all want Bitcoin, but they do want better returns. And where else do you get the security of 10X over collateralized debt?

These new Bitcoin-backed CDOs offer exactly that.

⚠️It’s going to take some time⚠️

Strategy (and the Treasury Companies that follow) can only issue as much debt as their Bitcoin treasuries can support.

Potential Supply grows as market cap grows.

🔁 That’s the flywheel:

Issue safe, well-collateralized Bitcoin debt

Attract capital

Use capital to acquire more BTC

Grow the balance sheet

Offer more debt products

Investors choose their risk tolerance and you’ve got a Bitcoin yield curve, emerging in real time — and it’s reflexive.

As long as the debt is heavily collateralized, even Bitcoin price dips won’t break the cycle.

This is how Bitcoin starts eating the debt markets.

📊 ETFs Update: Inflows continue

Despite the shortened 4th of July trading week, U.S. spot ETFs kept stacking:

🟢 BlackRock (IBIT): +3,088 BTC

🟢 Fidelity (FBTC): +2,166 BTC

🟢 ARK (ARKB): +1,449 BTC

Net Total: +7,047 BTC

That brings the 12-month total to over 380,000 BTC —

roughly 2% of total supply, absorbed in one year.

📊 Over that same stretch, Bitcoin price is up 91%.

That’s no coincidence.

This is exactly what you'd expect to see when relentless demand meets fixed supply.

Before We Finish- Let Me Know!

We’re building some Bitcoin tools, and we’d love a little help with the roadmap.

That’s your BTC Wealth Report this week.

Found this valuable? Answer the poll above!

Thank you!

— Thomas Fahrer